How do group benefits work? Who needs them? How do you choose health coverage for your employees? Find out the answers to these questions and more in this guide

Your employees are the lifeblood of your business; that’s why when it comes to compensation, they deserve the best package possible. The more your staff members feel that they are well-taken care of, the more likely they will stay and remain loyal to your company.

Offering health coverage for employees is one of the most effective ways to establish workers’ trust and commitment.

In this article, Benefits & Pensions Monitor gives you an overview of how employee health benefits work in Canada. We will break down the different types of coverage, along with the eligibility requirements. We will also provide tips on how you can pick the right health plans for your staff.

To the benefits specialists who typically visit our website, this piece can serve as a useful guide for your clients who may be on the lookout for the best health coverage for their employees.

How do employee health benefits work?

While we Canadians are fortunate to have access to government health insurance, the truth is, these plans don’t cover all healthcare costs. This is where employer-sponsored health plans – also called group benefits, group insurance, or workplace benefits – come into play.

Group benefit plans are designed to bridge the gap between what’s covered by public health insurance and what employees pay out of pocket. By easing the financial impact of private healthcare costs, this type of coverage not only protects your workers’ physical health but also their mental well-being.

As an employer, you are responsible for setting up – also called sponsor in industry buzzword – a group insurance plan. You can do so with the help of an insurance provider, which offers coverage and manages the different aspects of the health plan.

In most cases, you and your staff split the premiums, with the workers’ share typically deducted from their paycheques. You may also choose to cover the full cost of health coverage for employees.

Some group benefit plans give you the flexibility to customize the coverage options your employees can access. Others offer the same form of protection to all staff members.

If you need help in choosing the right group insurance provider, an experienced benefit plan consultant can assist you. The companies featured in our Top Pension and Group Benefits Consultants in Canada special report can guide you through the process.

Health coverage for employees: participation requirements

To purchase group health benefits, your business must meet these criteria:

- Group size: The minimum membership requirement varies depending on the insurance provider. Some insurers allow plans with two or three members. Others require that you enrol at least 50 employees.

- Membership eligibility: Plan members must be full-time working Canadian citizens or permanent residents not older than 75 years. They must also be covered by their provincial health insurance plan.

- Participation basis: If you choose to offer workplace benefits, all employees are required to enrol in the plan for your business to obtain and maintain coverage. There are a few insurers, however, that require at least 70% to 80% participation.

- Termination age: Coverage generally ends when an employee retires or reaches 75 years old, whichever comes first. Group insurance plans are also not portable, so your employees cannot retain coverage after they leave the company.

Most employer-sponsored benefits do not have waiting periods for tenured employees. New hires, however, may have to wait between 30 and 90 days before coverage begins. As an employer, it is also your responsibility to work with the insurance provider on the recalculation of premiums and renewal of the policy.

If you want to know more about how health coverage works, this comprehensive guide to health insurance in Canada from our sister publication Insurance Business can be a useful resource.

What are the different types of employee health benefits?

Health coverage for employees comes in several forms. These are the most common types of protection a group benefit plan provides:

- Accidental death and dismemberment (AD&D) coverage: This benefit provides financial assistance to the employee’s family if they die from an accident. It also covers your staff if they lose a limb, or their vision, hearing, or speech, or become paralyzed due to an accident.

- Critical illness insurance: This provides a lump-sum payment to an employee following a life-altering diagnosis of a covered condition.

- Dental care coverage: This pays for dental and oral health procedures done by licensed professionals. Depending on the policy, dental insurance coverage can range from routine check-ups and preventative care to major operations.

- Disability benefits: These are designed to replace a part of an employee’s income if an illness or injury prevents them from working. It is best for employers to sponsor a combination of short- and long-term disability coverage to assist staff members.

- Emergency medical travel insurance: This covers medical emergencies while the employee is travelling. Coverage can include hospital and treatment costs and medical evacuations.

- Group life insurance: This provides a lump-sum payment to the employee’s family if they die. Life insurance coverage kicks in regardless of whether the cause of death is natural or accident.

- Paramedical coverage: This pays for healthcare services that workers access to improve their physical and mental well-being. These include physiotherapists, chiropractors, massage therapist, dieticians, and mental health workers.

- Prescription drug coverage: This pays for medication prescribed by a medical or healthcare professional. These drugs must be medically necessary and have a drug identification number (DIN), which signifies that they are authorized for use by Health Canada.

- Vision care benefit: This covers procedures and services aimed at improving eye health. Coverage often includes routine eye exams, eyeglasses, and contact lenses.

You can also sponsor health spending accounts (HSA) for your staff. HSAs work by providing members credits – usually a set amount – that they can use for healthcare expenses not covered by provincial or employer-sponsored plans.

Another type of health coverage for employees that has been gaining popularity in recent years is flexible benefit plans. These plans – also called flex plans – allow employees to choose the benefits under their plans. Members are given credits that they can distribute to various coverage options that suit their and their families’ needs. Workers are often allowed to go beyond their credit limits, as long as they shoulder the additional cost.

Learn more about the most popular employee benefits in Canada in this guide.

How to choose health coverage for your employees

When picking the right health coverage for your employees, there are several factors that you need to consider:

1. Employee demographics

Employees come from different age groups and backgrounds. This means that their coverage needs vary as well. Older workers may place more value on benefits that can also protect their families. Younger staff members may put a premium on their own health and well-being needs such as paramedical services.

It is important for you to consider your workforce’s average age and common characteristics when deciding on which types of health coverage to obtain. Conducting an anonymous survey can be an effective way of determining what your employees are looking for in a group benefits plan.

2. Accurate budgeting

How much can you afford to spend on health coverage for employees? This is one of the most important questions you need to answer before choosing a group insurance plan. Accurate budgeting gives you an idea of what a reasonable premium is. This also prevents you from incurring coverage costs that can eat into your revenue.

The table below shows the average cost of employee health benefits based on the insurer and price comparison websites the BPM research team checked out.

Health coverage for employees: how much does it cost?

|

Company size |

Annual premiums |

|

Up to 50 employees |

$1,500 to $4,000 |

|

51 to 250 employees |

$1,200 to $3,500 |

|

More than 250 employees |

$1,000 to $3,000 |

3. Coverage options

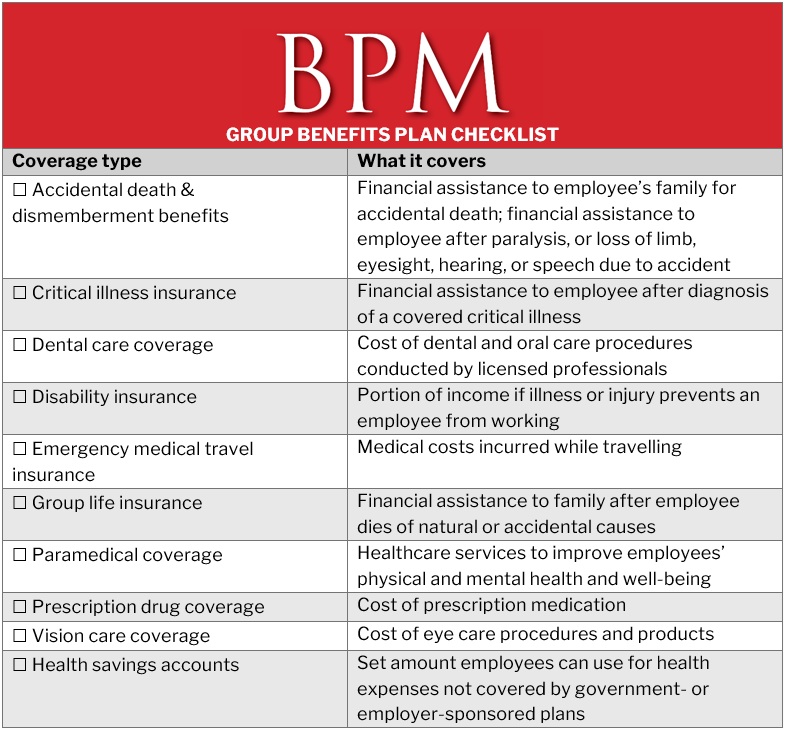

You can choose from a range of coverage options for your employees. Here is a checklist of the different types of employee health benefits you can include in your company’s group plan. You can download the checklist for easy reference.

4. Flexible plans

Because employees and their families have different health needs, they can benefit from having a flexible health plan. Many group insurance companies provide employees with a set amount that they can allocate to different coverage options that suit their and their families’ needs. Workers can choose to get coverage that exceeds their credit limit, but they will have to pay for the excess cost.

5. Insurance provider

Look for a reputable group insurance provider that can assist you in managing health coverage for your employees like the ones on our list of the largest group benefit insurers in Canada. These insurers must also provide tools that can help with streamlining processes, including record maintenance, premium deposit, and claims payouts.

Check out this guide for more practical tips on how to choose employee benefit plans.

What are the benefits of providing health coverage for employees?

Employers offer group benefits for several reasons, the biggest of which is to attract and retain top talent. The more unique and generous employee health benefits you can provide, the more likely that high-quality candidates are going to accept your offer.

But apart from remaining competitive in the war for talent, a comprehensive group plan brings a lot of advantages to your company. These include:

- Enhanced productivity and job satisfaction: With their and their family’s health needs covered, employees can focus on doing their jobs well. Workers may also feel valued and supported, which can help build loyalty. Because of this, they are more likely to stay with your company.

- Promotes employee wellness: Having a comprehensive group benefits plan encourages your staff to prioritize their health. This, in turn, fosters a culture of wellness in your business. Healthy employees are more productive and can help you cut healthcare expenses in the long run.

- Access to tax benefits: The premiums you pay for group benefit plans are tax-deductible for your business. These tax benefits can help offset the cost of health coverage for employees.

Here is a list of what a solid group benefit plan can do for your company:

- attract top talent

- reduce employee turnover

- build stronger employer-employee relationships

- promote a culture of wellness

- increase employee productivity

- boost employee morale and engagement

- foster a supportive culture

- give businesses access to tax benefits

Employees form the backbone of your company. Without them, your business is bound to fail. The most successful businesses know how to take care of their workforce. Offering health coverage for employees is one way of doing so.

Group health benefits not only protect the physical and mental well-being of your workers, but these plans also make your staff feel valued and supported. In the long run, the positive relationships you build with employees can help bring valuable returns for your business in the form of increased productivity, reduced turnover, and higher revenue.

If you are looking for companies to model your employee benefits offering from, you can check out our list of the Best Companies to Work for in the Benefits, Pension, and Institutional Investment Space. Find out how these industry leaders take care of their workforce in this special report.

Did you find this guide on health coverage for employees helpful? Let us know in the comments.