The Top Financial Executives and Professionals in the Benefits,

Pensions, and Institutional Investment Industries | Hot List 2024

Jump to winners | Jump to methodology

People before profit

Exceptional performers in the benefits, pension, and institutional investment sectors are not driven by profit, but by ensuring they deliver for the public at large. That’s the verdict of Riley St. Jacques, partner and senior consulting actuary with PBI Actuarial Consultants.

“The people involved in this space should focus not on sales or profitability, but on supporting core groups like Canadians in meeting their benefit and pension needs,” he remarks. “This work should prioritize the public good over profit-driven innovation. I believe leadership in this area should centre on serving the greater public interest rather than individual company or sponsored results.”

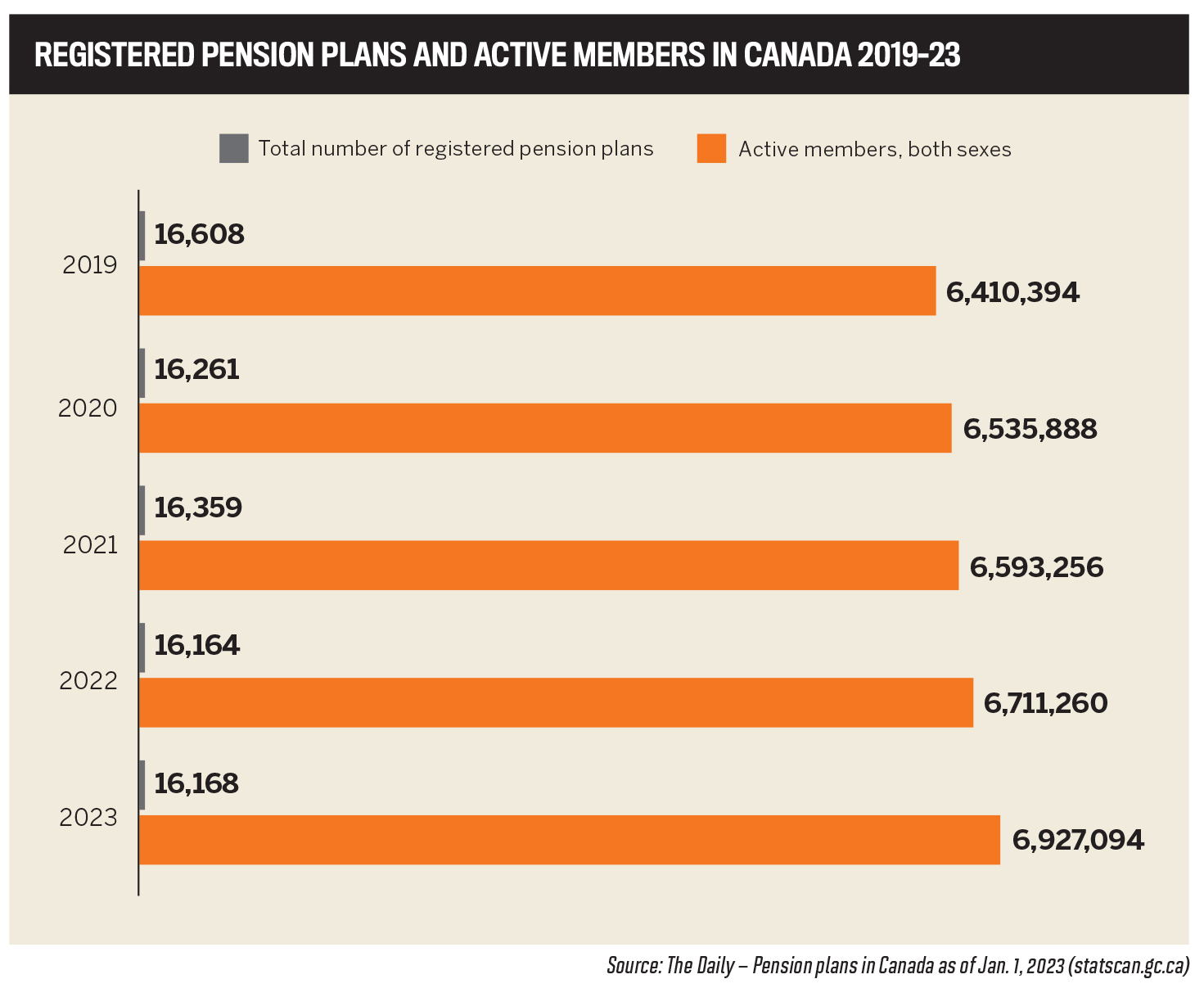

The growth of registered pension plans and active members in Canada from 2019 to 2023, an 8.1 percent increase, highlights the increased demands on Benefits and Pensions Monitor’s Hot List.

Outlining the essential qualities that leading professionals in the various financial spaces need to possess, St. Jacques notes the following:

Benefits and pensions professionals

- volunteering on boards and associations advocating for legislative reform

- leadership in undefined spaces, such as the decumulation of pensions

- innovating benefit solutions that are not downloading government benefits to employers but meeting employee needs

- working toward results-driven solutions versus short-term cost savings

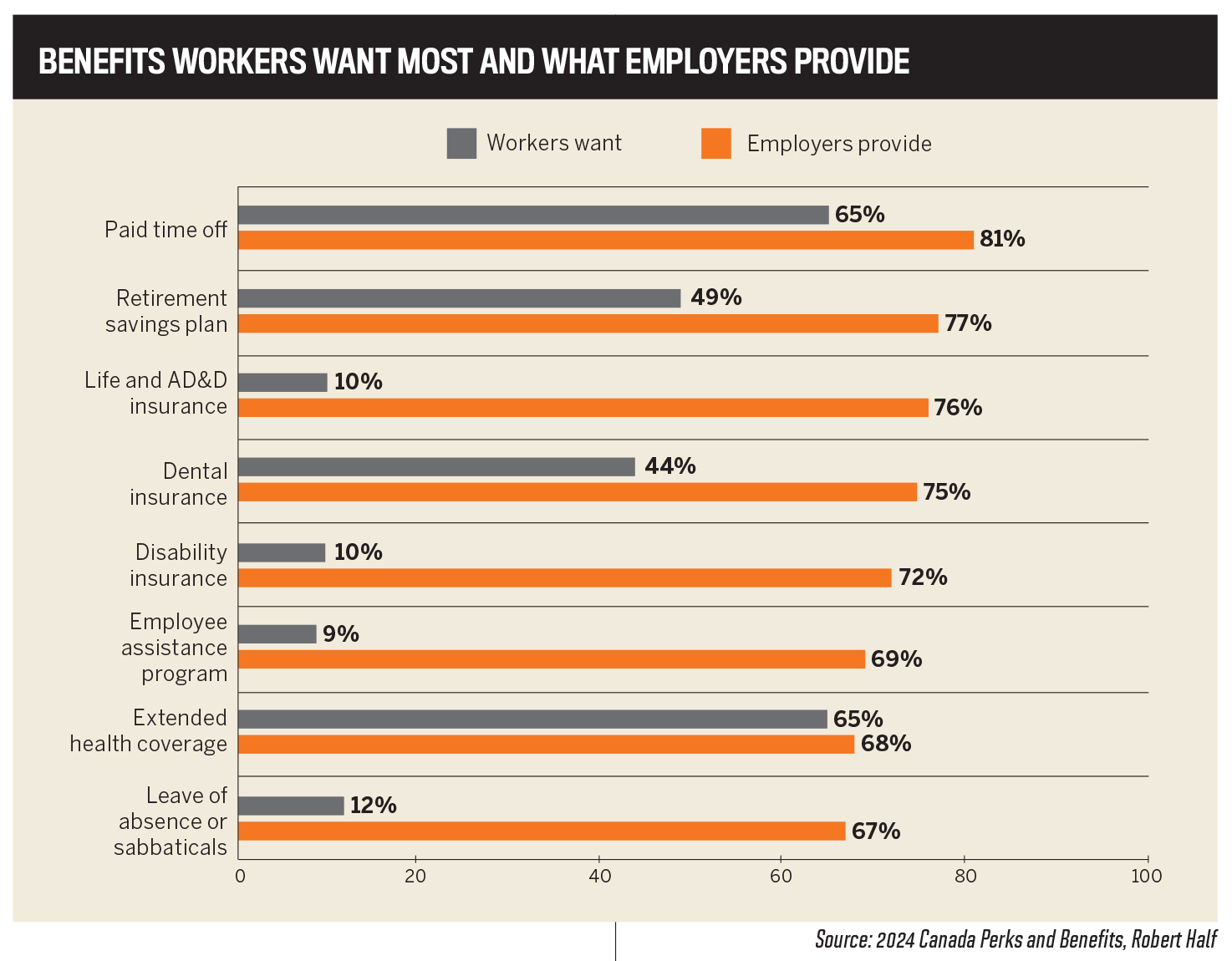

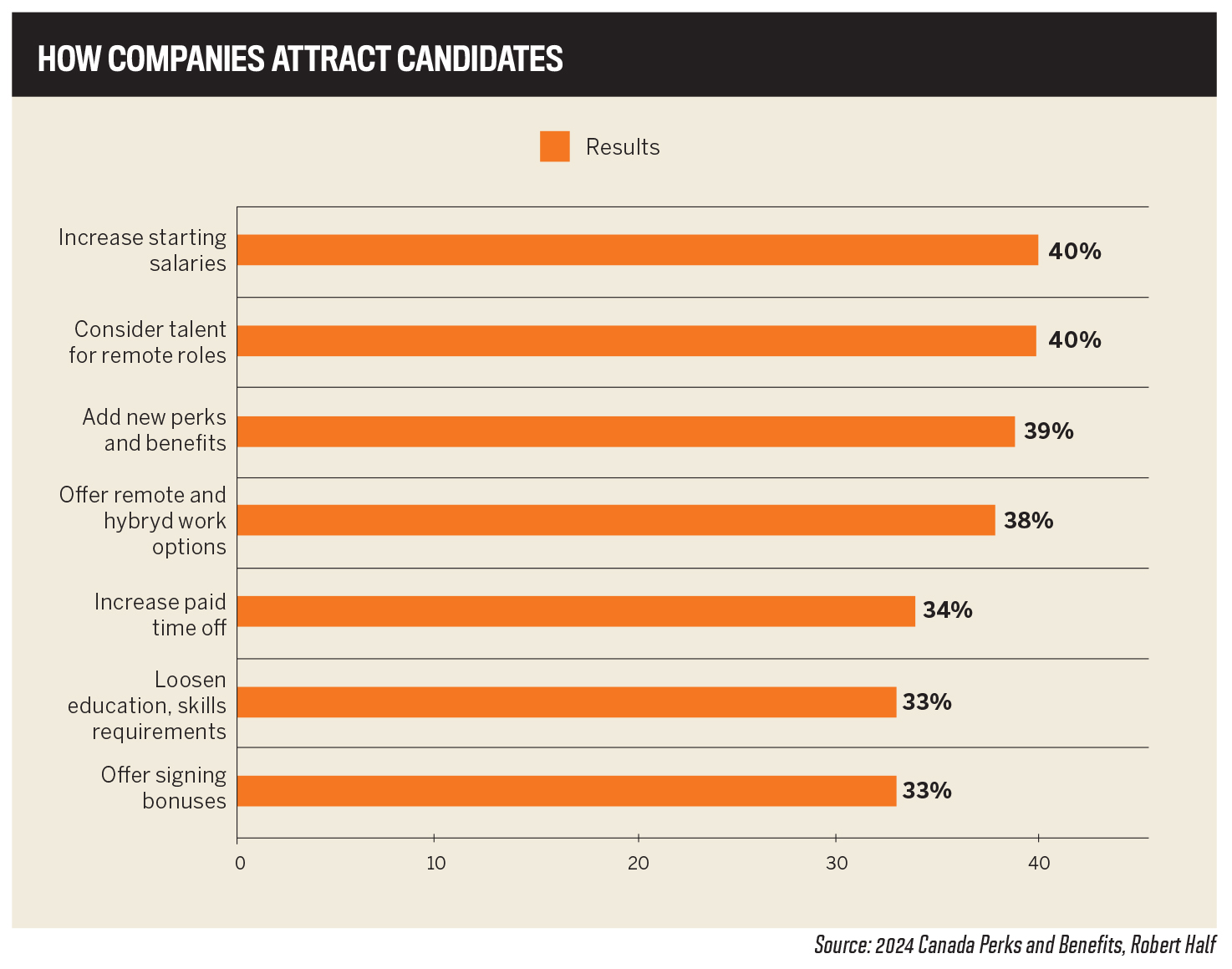

Top-performing professionals in the benefits industry, such as BPM’s awardees, have demonstrated their understanding of the balance between meeting employee expectations and providing comprehensive packages.

The graphs below illustrate how organizations are exceeding workers’ wish lists in several areas, showcasing their commitment to employee well-being and satisfaction.

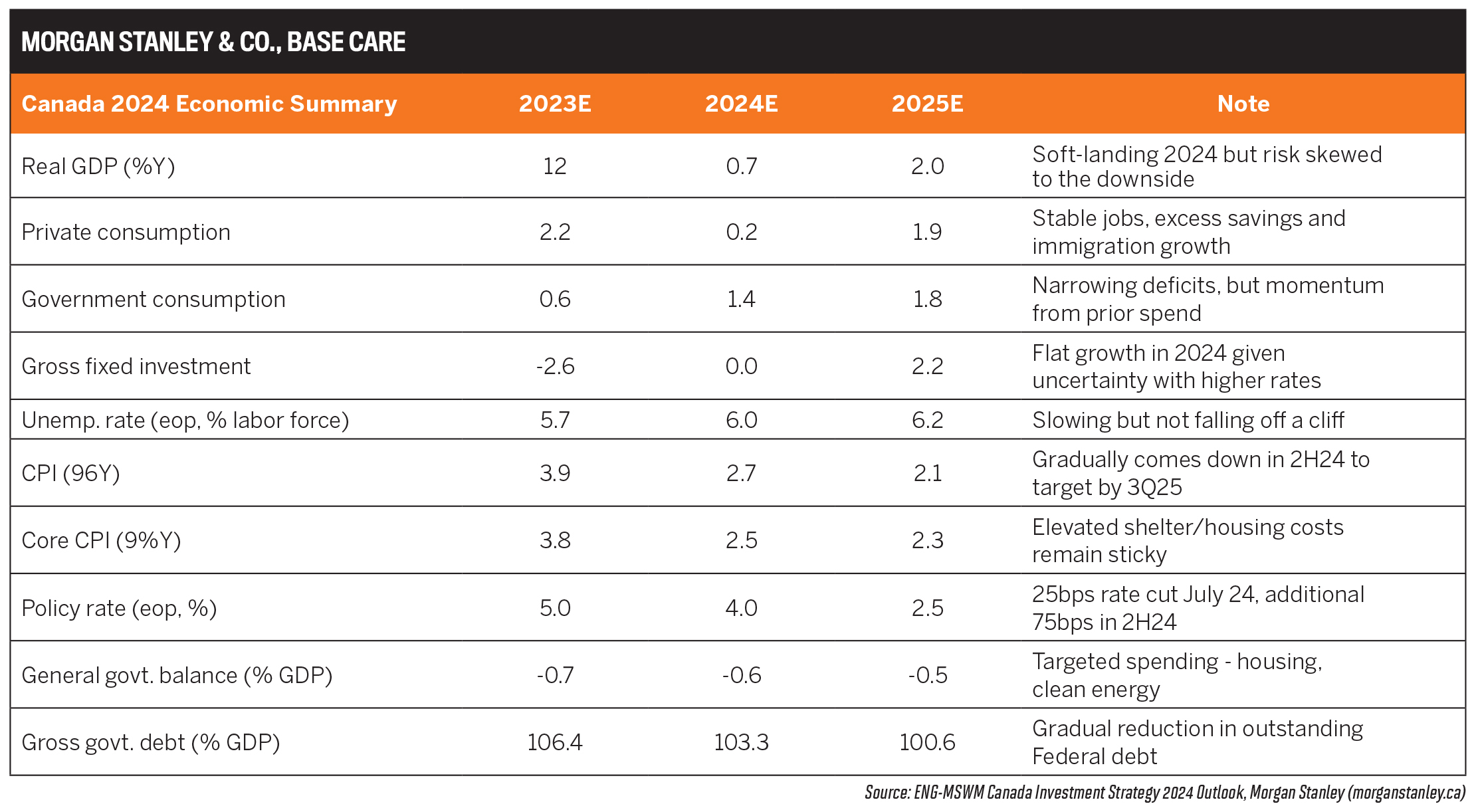

For top financial executives and professionals in the institutional investment space, the ability to anticipate macroeconomic shifts and tailor their strategies both in the short and long terms, positions them as exceptional market players.

Institutional investment professionals

- defined contribution investment solutions that reduce fees

- education for members, boards, and committees should focus on broadening knowledge beyond achieving better returns

“Professionals should be seeking solutions that make meaningful shifts in results, not just in terms of returns, but also in helping people truly understand what’s happening in the markets and where they’re headed,” adds St. Jacques.

“It’s challenging to pinpoint specific changes because it’s so subjective; what’s considered an acceptable level of risk and the philosophies or directions to pursue vary widely,” he continues. “However, any strong leader in the investment space should focus on education, ensuring a true understanding of the investments being made, rather than just concentrating on basic returns.”

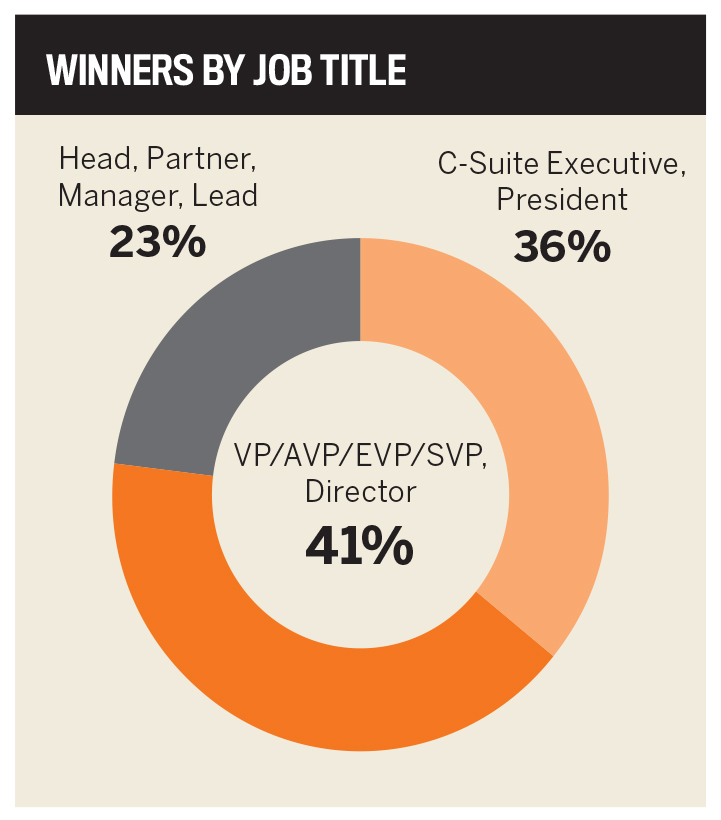

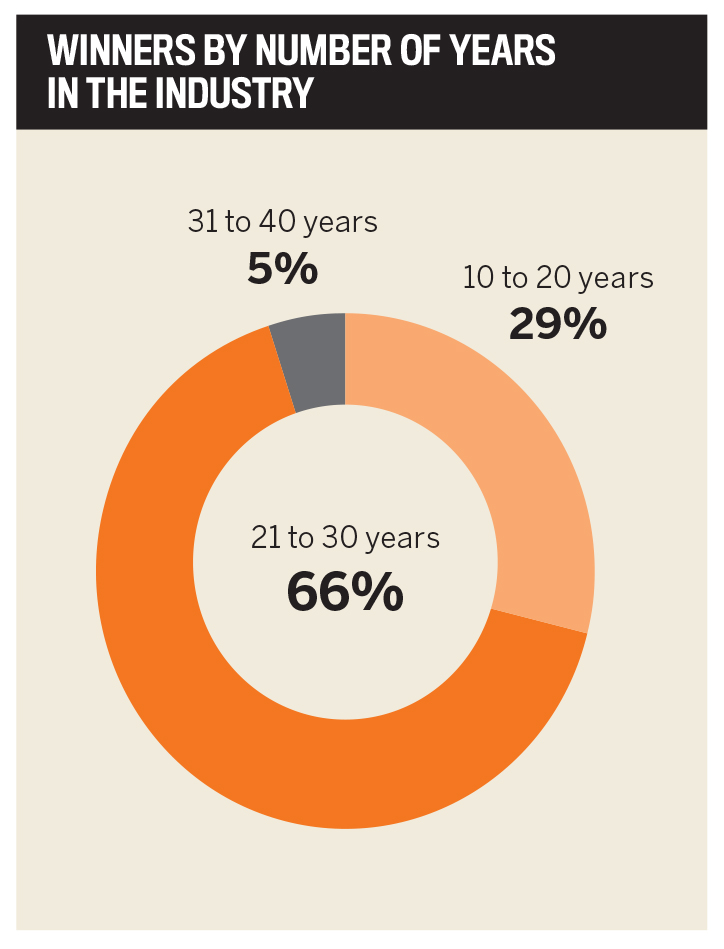

In determining the Hot List 2024, BPM recognizes 39 top financial executives and professionals in the benefits, pension, and institutional investment sectors, spotlighting a thriving group of disruptors and innovators that have significantly shaped their industries.

To be named to the second annual Hot List, nominees had to have over a decade of experience and have made substantial strides in their fields, showcasing outstanding leadership, pioneering new solutions, and leaving a notable impact across their professional footprint over the past 12 months.

2024’s Hot List winners disrupting the industry with innovation

Over a successful 35-year insurance career, the vice president developed a passion for healthcare and helping Canadians access timely and potentially life-saving tests and treatments, particularly as local health networks have come under strain.

That enduring drive led Stirpe to become a disruptor – a certified health insurance specialist credited with introducing international private medical insurance (IPMI) to the Canadian marketplace.

He has forged relationships with top brokerages, raising awareness of this new type of insurance available and backed by Canada’s innovative Humania Assurance. Within just one year, VUMI Canada has become the largest national provider of IPMI, following Royal & Sun Alliance’s exit from the Canadian marketplace and Vumi’s acquisition of its entire PPI Tri Access block of business.

VUMI has also rolled out initiatives to solidify its reputation as the go-to provider for Canadians looking to expand their healthcare options globally. It has set new standards with a focus on:

- personalized service to enhance client access to worldwide healthcare

- providing innovative services such as ‘patient concierge’ and ‘second medical opinion’ as part of the package

“For VUMI, this meant expanding healthcare options for Canadians while offering them easy access to world-renowned doctors and hospitals worldwide,” Stirpe says. “The trend toward prioritizing client experience has reinforced our commitment to delivering VIP care that sets us apart. Our VIP products are designed to meet the unique needs of employees, as individuals, and families, without jumping through the loops of issues existing within the national healthcare system.”

Gino StirpeVUMI Canada

The impact of owning the Prestige VIP health insurance plan is evident in patients’ health journeys, with one insured receiving care from a top orthopedic specialist for damage to his quadricep while water skiing within five days.

Over the last year, the industry has been defined by a need for personalized and responsive service, asserts Stirpe. VUMI Canada’s Prestige VIP niche product is typically sold to C-suite executives in groups by employee benefits brokers, consultants, and third-party administrators.

“Being one of the pioneers who did this and working with other partners to make them aware is the wind in my sails,” he says. “We’re in the early stages, but we’ve experienced exponential growth.”

As a three-decade-long member of Advocis, a leading association for financial advisors and insurance specialists, Stirpe has made several notable industry contributions:

- celebrated a 30-year milestone membership

- frequent speaker and sought-after presenter at numerous industry events nationally

- actively involved in study groups for employee benefits, including with the Conference for Advanced Life Underwriting

“Our motivation comes from a deep commitment to providing our insureds with unparalleled VIP service and care,” Stirpe adds. “Our clients seek flexible solutions, access to world-renowned hospitals and facilities, and the assurance of coverage anytime, anywhere.”

The co-CEO joined the firm in 2023 as it approaches a major milestone this year, a quarter century since its founding. Similarly, Simunac will celebrate 25 years of lending and private debt management next year.

“Like Stonebridge, I am just getting warmed up, and is why I joined the firm,” he says. “We see so much opportunity within private debt to grow and add value to clients while generating prudent but compelling returns for our investors.”

Simunac forged his credit risk and portfolio management experience at leading Canadian, European, and US regulated institutions, including Sun Life Financial, TD Bank, Allied Irish Bank, and Raymond James Bank.

Before joining Stonebridge, he served as the inaugural principal officer for two new banks entering Canada, where he led the efforts to build their loan portfolios and grow each firm conservatively and profitably into well-respected lenders, as recognized by clients, other financial institutions, and regulators.

“I was promoted to country head of a foreign bank at age 30 at the height of the GFC; that was very formative for me,” Simunac reflects. “Building two banks new to Canada was a grassroots, entrepreneurial experience. I had considerable ownership and accountability regarding strategies, and I managed such decisions on behalf of shareholders, accordingly.”

To date, Simunac has committed over $15 billion across various markets and asset classes in his career. He joined Stonebridge to reinforce the firm’s expertise as a leader in infrastructure, renewable power, and healthcare private debt while expanding its experience in real estate (commercial mortgages) and corporate private credit.

Daniel SimunacStonebridge Financial

“I have been fortunate to be involved in a wide range of transactions across different sectors and geographies and to experience how various asset classes, markets, and borrowers withstand various economic cycles,” he notes. “This has helped the lending teams I have led avoid certain issues while leaning into other, more resilient opportunities.”

Aside from his personal achievements, Simunac is particularly proud of Stonebridge’s track record of zero losses since its inception as an investment manager. Building on this success, he has already brought new capital and relationships to the firm. Among Simunac’s significant contributions are:

- chairing the Tournament of Stars NBA Celebrity Fundraiser in support of West Park Hospital since 2018

- being a Realpac/TMU lecturer of Commercial Lending, a course he created and has taught since 2013

- receiving the Executive of the Year Award from the Canadian-Croatian Chamber of Commerce

Some of Stonebridge’s notable achievements include:

- achieving $3.2 billion in AUMA, an approximately 10 percent annual growth rate over the last two decades

- recipient of the Indigenous Allyship Award by the First Nations Power Authority and a Clean50 Award

- launching funds that help crowd-in pension capital into social, sustainable, and Indigenous investments

As part of the firm’s 25th anniversary, aside from a corporate rebrand and publishing its inaugural sustainability report, Stonebridge is launching its third infrastructure debt fund, which will continue to focus on social infrastructure, sustainable power, and Indigenous investments.

Stonebridge was the first manager in Canada to launch such funds in 2012, raising over $200 million, with its second fund growing to nearly $600 million, three times the size of the first. These funds averaged 38 percent of commitments to Indigenous projects, including financing the first 100 percent-owned power project by a First Nation. Building on the success of its first two funds, Stonebridge is targeting $1 billion for its third fund.

Simunac believes market intelligence comes from market experience, and he has plenty of it. When asked how tall Stonebridge can grow, he says, “The broader the base, the taller the tower. Ask me in 20 years. We’re just getting warmed up.”

With nearly $9 million in annual premiums and a growing client roster of 120, the employee benefits advisor has set a high benchmark for his solo brokerage operation, which manages employee benefits for startups of all sizes in Canada and internationally.

“One of the things I did several years ago was I started using a group MGA to handle marketing, claims experience reports, and document preparation, which freed up my time to focus on growth, and I’ve more than doubled my business over the past eight years,” Gory says.

The precious time saved by offloading back-office paperwork has enabled Gory to concentrate on serving the technology sector, which now comprises over 90 percent of his client base. He counts social media innovator Snapchat among the tech companies for which he manages employee benefits across Canada.

Gory’s first client in Toronto’s then-blossoming tech community, which had four employees nearly 20 years ago, remains his client today and now boasts a workforce of 330. He has embraced technology to streamline his operations, hiring consultants to develop bespoke solutions such as integration between Salesforce, which he has customized, and a secure customer portal on ShareFile.

Gory has observed a shift in the tech sector, with employers focusing on benefits relating to fertility, gender reassignment, and mental health. Over the past year, employers have been keen to offer discounts and perks at no cost to them, which sets Gory apart through his partnership with Rexall, providing his plan members with a 20 percent discount.

Christopher GoryOrchard Benefits

As many of his clients are smaller tech founders juggling various roles, his support extends to enterprise subscriptions with ConnectsUs HR and My Friendly Lawyer, while his prior experience as a computer programmer resonates with their needs.

Giving back to the industry is paramount for Gory, who lends his expertise to various committees of the Benefits Alliance and has:

- developed a new benchmarking tool driven by data from member firms

- vetted new partners and executive health care products for their members

- revived the alliance’s Slack channel, engaging members across Canada

- received the Fast Start award at the Spark Conference

He is also the lone voice of the small advisor on an Innovative Medicines Canada committee and represents the small group benefits industry with the Canadian Group Insurance Brokers Association, where he manages its hundreds-member strong Slack channel nationally.

“I’ve always been a person who likes giving back,” he shares. “I don’t know everything, and if I can help engage the community, when it’s my turn to ask a question, there will be an answer because it’s a two-way street.”

Her early days were in the cooperative and credit union sector, where she analyzed how the cooperative model could deliver better social and economic outcomes. Rohan also lived and worked in South Africa on a project funded by the International Finance Corporation focusing on the Black economic empowerment agenda in the post-apartheid era, and she brought significant expertise to SHARE on returning to Canada in 2006.

As the chief strategy officer, she has been instrumental in the organization’s growth from seven employees to a 37-member team, an achievement she considers her most fulfilling to date.

Rohan’s quiet leadership has been central in creating the ecosystem for pension and benefit plans to act as responsible investors in Canada. Her behind-the-scenes guidance has benefited many existing practices, tools, and networks.

“That’s what gets me up every day and the work that motivates me,” she says. “I enjoy working with pension funds and helping them to untangle what is often a complex area of work and carve a meaningful pathway for those pension funds to take steps in implementing responsible investments.”

Rohan excels in assisting pension plans to develop investment beliefs and practices that effectively manage environmental, social, and governance (ESG) risks. The approach her organization takes to build a strong foundation and align their policies, procedures, and relationships with service providers include:

- gathering information through surveys or focus group discussions with relevant parties, such as the board of trustees, investment committees, or staff

- identifying areas of consensus, focusing on commonly held perspectives on ESG issues to their obligations as a pension fund

- avoiding a one-size-fits-all approach, considering the pension fund’s unique characteristics, such as investment strategy, governance model, and beneficiary needs

- assessing how to implement responsible investment policies, including evaluating asset manager information and taking steps to enhance the fund’s capacity

A challenge Rohan faces when working with pension funds is making a case for why ESG issues are relevant and their ability to deliver on the pension promise.

Shannon RohanShareholder Association for Research & Education

“It can feel like they are on the receiving end of a fire hose of information, and our job as responsible investment experts and advisers is to help the plans focus on the key pieces of information and develop manageable and meaningful roadmaps,” she explains.

She leverages strategic approaches to advance the cause, including converting and tailoring expert knowledge on human rights, climate change, and labour rights with a financial lens into concise, actionable insights on what matters most.

Responsible investment is one piece of the puzzle that pension funds and asset managers must consider regarding investment performance. Under Rohan’s leadership, SHARE’s collaborative model assists these entities to work together toward a common set of goals while deploying their resources effectively.

Two recent examples of this technique in action are:

- Developed a common ESG questionnaire: Collaborated with a group of universities to create a shared ESG questionnaire for asset managers, streamlining resources and reducing redundancy. The tool is publicly available, providing critical questions for responsible investment and benefiting universities and asset managers by standardizing key focus areas.

- Facilitated constructive dialogues around responsible investment: Brought together asset owners and pension funds who share the same asset managers in a purposeful conversation around responsible investment. This initiative enabled effective resource use and straightforward, collaborative dialogue on priorities, helping pension funds focus on key areas and hold their asset managers accountable.

Rohan volunteers as treasurer of the board of the First Peoples’ Cultural Foundation. SHARE has also formed a partnership initiative with the National Aboriginal Trust Officers Association known as the Reconciliation and Responsible Investment Initiative (RRII). She remarks that pension plans are increasingly interested in understanding their role in reconciliation in Canada and responding to the Truth and Reconciliation Commission’s Calls to Action.

SHARE also partners with Indigenous-led organizations, such as the National Aboriginal Trust Officers Association, to connect pension funds with Indigenous trustees who face similar challenges in overseeing capital pools established through land settlements and economic activities.

“I think the most important thing we’ve learned as a non-Indigenous organization working in this space is that leadership must come from Indigenous leaders,” she says. “We strongly encourage pension funds to connect with the communities and First Nations where they work, build relationships, and engage with Indigenous-led organizations. This connection is critical, and it’s a lesson we’ve embraced and aim to pass on to pension funds as they begin their journey toward reconciliation.”

The Top Financial Executives and Professionals in the

Benefits, Pensions, and Institutional Investment Industries | Hot List 2024

- Aaron Bennett

Chief Investment Officer

University Pension Plan - Anne Meloche

Head of Institutional Business

Sun Life Global Investments - Arif Bhalwani

Chief Executive Officer

Third Eye Capital - Celine Chiovitti

Chief Pension Officer

OMERS - Cheldon Angus

Chief People and Technology Officer

Saskatchewan Healthcare Employees’ Pension Plan (SHEPP) - Chelsea Kittleson

Executive Director

Municipal Pension Plan - Chris Weitzel

Senior Managing Director, Fixed Income & Foreign Exchange

BCI - Christina Iacoucci

Managing Partner, Head of Canada

BGO - Doug Woloshyn

New President and CEO

Alberta Pension Services Corporation - Graham Young

Chair, Benefits Alliance Board; Director, Employee Benefits, Capcorp;

Director, Ottawa Executive Association - Greg Heise

Partner

George & Bell Consulting - Ibrahim Toor

Director of Pension

Grand River Hospital - Jamal Siddiqui

AVP Trust Finance Operations & Compliance, CWB Trust Services;

Chair, Canadian Pension & Benefits Institute (CPBI) Pacific;

Co-Chair of Pacific Education Programs, CWB Trust Services - James Ash

Chief Investment Officer and Treasurer

CIBC Pension Plan (Canadian Imperial Bank of Commerce) - Joanna Walewski

Lead Specialist, Benefits and Pension

AltaGas - Karen McKeown

Director, Board Operations and Board Secretary

BC Pension Corporation - Kim Connor

Vice President, Partnerships

Dialogue Health Technologies - Laura Brownell

Trustee

University Pension Plan, Ontario - Lauren Bloom

Head of Canada

T. Rowe Price - Lorianne Weston

Manager, Pension Hub

Global Risk Institute in Financial Services - Matthew Chow

Chief Mental Health Officer

TELUS Health - Marie-Chantal Côté

Senior Vice President, Group Benefits

Sun Life Canada - Pierre Caron

President

Conseil Phialex - Rana Ghorayeb

Senior Vice President and Head of Real Estate

Caisse de dépôt et placement du Québec - Roger Beauchemin

President and Chief Executive Officer

Addenda Capital - Ryan Johnston

Corporate Account Executive

Manulife Financial - Sean Hewitt

President

Vestcor - Tami Dove

Director, Member Experience

CSS Pension Plan (Co-operative Superannuation Society) - Todd Saulnier

Principal, Mercer Canada

President, Association of Canadian Pension

Management BOD (ACPM) - Tola Oduntan

Manager, Member and Stakeholder Relations

Plannera Pensions & Benefits - Tracy Young-McLean

Vice President Human Resources and Corporate Services

Rise Air - William (Bill) Butt

Director

CI Financial - Yafa Sakkejha

Chief Executive Officer

Beneplan

Insights

Methodology

In May 2024, Benefits and Pensions Monitor invited industry professionals from across the country to nominate their most exceptional leaders for the second annual Hot List. Nominees had to have been in the industry for at least 10 years.

After receiving hundreds of nominations, BPM narrowed the list down to 39 movers and shakers whose contributions have helped shape the benefits, pension, and institutional investment space over the past 12 months.

From innovators at the forefront of change to leaders who are transforming the way the industry does business, this year’s Hot List represents the best the industry has to offer.