Ripsman - We may see the Canadian economy slide into a recession in 2024, which could trigger the BoC to more aggressively cut interest rates

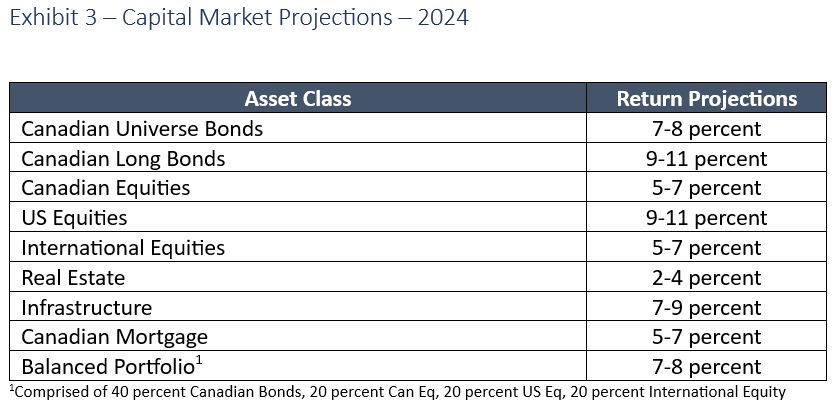

Despite its rocky start, 2023 was a strong year for pension funds. The median global balanced portfolio earned 10.9 percent in 2023, aiding pension funds. Looking at 2024, we expect to see equity returns in the six to 11 percent range depending on the region. The hero in 2024 is expected to be bond portfolios, which we expect to benefit from attractive current yield levels of four percent in core Canadian bond portfolios, as well as capital gains as interest rates begin to fall.

Economic Growth

In Canada, we expect low to negative economic growth to continue as a consequence of reduced spending by Canadians and stagnant economic activity globally weighing down demand for materials. Canadians are near all time high levels of personal debt to disposable income (181 percent), well above the levels of US consumers ahead of the Financial Crisis in 2008. In Canada, 74.3 percent of consumer debt is from mortgages. As Canadians renew their mortgages, their discretionary incomes will continue to decline, which will act as a drag on economic growth and help to moderate inflation. We may see the Canadian economy slide into a recession in 2024, which could trigger the BoC to more aggressively cut interest rates.

We expect the US to maintain modest GDP growth in 2024 supported by strong demand for products from the tech sector. Additionally, we expect interest rate cuts to support the economy ahead of the upcoming US presidential election in 2024.

We expect 2024 to be a weak year for European and UK GDP growth as disruptions related to the Russia-Ukraine conflict continue to negatively impact economic activity. However, as these regions are also experiencing inflation at levels higher than in North America, we do not expect the BoE or ECB to cut interest rates in 2024 in an attempt to stimulate their economies.

Interest Rates

We have experienced rising interest rates over the last two years as a consequence of central bank actions to slow inflation. This inflation was largely a consequence of massive government stimulus spending in 2020 and 2021, to support the economy in the face of COVID lock downs and disruptions. Interest rates plateaued at generationally high levels, in 2023. In 2024, we can expect rates to slowly begin to decline, particularly in the second half of the year.

Canadian and US inflation levels peaked in mid-2022 and have fallen steadily since that time (see Exhibit 1). Currently Canadian annual inflation levels sit in the range of three to four percent, still above the long-term Bank of Canada target of two percent.

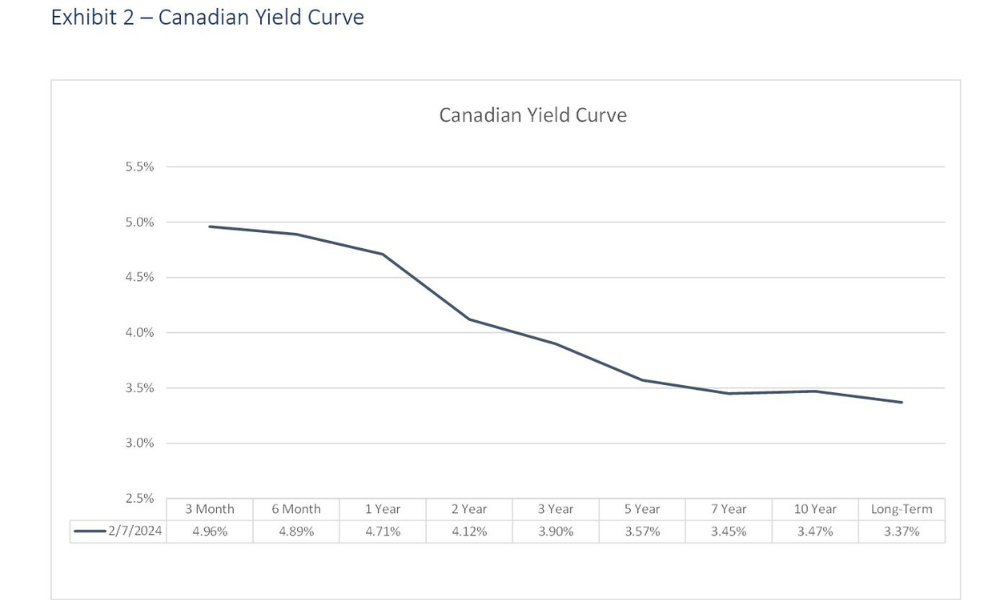

Given the attractive current yields, and potential for interest rate cuts, which will generate capital gains, we can expect Canadian fixed income portfolios to perform strongly over the course of 2024. The current yield curve reflects market expectations of a drop in interest rates of approximately 0.5 percent over the course of the next year (see Exhibit 2 below). If mid-term rates were to fall by 0.5 percent, we expect fixed income portfolios to generate returns in the seven to eight percent range.

We expect long bonds to outperform universe bonds in a falling interest rate environment. A prolonged economic slowdown may widen corporate bond spreads, causing them to underperform government bonds.

European and UK inflation levels peaked in early 2023. They are still running at higher levels than in North America. This may result in delayed, or slower, interest rate cuts overseas.

Over 2023 and into 2024, we have seen a continuing steepening of the Canadian yield curve (falling longer-term yields), illustrating the market’s expectation of rate cuts in Canada over 2024.

Equities

In Canada, we are anticipating a more challenging equities market in 2024, as corporate profits are dampened by lower or and possibly negative GDP growth and declining consumer spending. We also expect sluggish global economic growth to slow demand and put downward pressure on commodities prices, which will act as a drag on stocks in the energy and materials sectors, two important sectors in the Canadian economy. At the same time, anticipated interest rate cuts in the latter half of the year may act to kickstart the economy and begin to bolster corporate earnings. Overall, we expect Canadian equity returns in the five to seven percent range for the year, well below 2023 returns.

We expect the US economy to remain moderately strong in 2024 and avoid a recession. Investors looking to take advantage of a stronger US economy, heading into an election year, should increase allocations to the US equities, which will help shield portfolios from global economic uncertainty and geopolitical conflict in and around Europe. We expect the US equity market to continue to benefit from its technology sector as the Artificial Intelligence revolution continues. In the current economic environment, we expect to see strong US equity returns in the range of nine to 11 percent.

We expect European and UK equities to underperform US equities, as higher inflation levels will support higher interest rates throughout the year, which will slow economic activity and spending levels. Continuing disruptions related to the Russia-Ukraine conflict will contribute to weaker economic conditions, and continue to stress earnings for companies in these regions. Overall, we expect European equity returns in the 5-8 percent range for the year, well below 2023 returns.

Our view of slowing global economic growth in 2024 suggests that corporate earnings growth should decline over the year. Declining EPS growth rates will have an outsized impact on growth company valuations, relative to valuations for value-oriented companies. Given the current stretched valuations for many large growth companies, following a strong 2023, particularly in the technology sector, we expect growth-oriented portfolios to underperform their value-oriented counterparts.

Alternatives

We expect Canadian real estate to have another challenging year, with low single digit returns in 2024, as property valuations, particularly in the office sector, continue to adjust downwards. At the same time, infrastructure investments should experience a strong year, as they benefit from continued infrastructure program spending and interest rate cuts.

Despite their higher yields, we expect mortgage funds to underperform bond funds in a falling interest rate environment, due to their shorter durations.

Capital Market Assumptions

The following table outlines our capital market expectations for 2024 (Exhibit 3).

Recommendations for Pension Plan Sponsors

Based on our capital market projections, pension plan sponsors should consider the following strategies:

- Increasing allocations to fixed income;

- Lengthening the duration of fixed income portfolios;

- Many plan sponsors employed a mismatch in their fixed income duration (a shorter duration in their fixed income portfolios than their underlying plan liabilities) to take advantage of rising rates. It may be time to lengthen bond durations to protect pension plans from the impact of expected rate cuts.

- Increasing the regional allocation to US equities, relative to Canadian and international equities; and

- Reducing exposure to real estate equity, which may experience a correction (particularly in the office and retail sectors).

Colin Ripsman is the president and founder of Elegant Investment Solutions Inc., a boutique consulting firm specializing in investment consulting and governance.