February sees a 0.2% rise in GDP, with transportation and warehousing driving growth amid economic challenges

The Canadian economy experienced modest growth in February 2024, as reported by Statistics Canada on Tuesday.

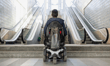

Real gross domestic product (GDP) rose 0.2 per cent following a 0.5 per cent increase in January. Leading the growth for the second consecutive month were services-producing industries, which increased by 0.2 per cent, driven by gains in the transportation and warehousing sector.

Transportation and warehousing demonstrated notable growth, increasing by 1.4 per cent in February, marking the largest monthly growth rate since January 2023.

This sector saw broad-based gains across six of its nine subsectors, with a significant rebound in rail transportation, which rose 5.5 per cent.

Air transportation also saw substantial growth, increasing 4.8 per cent—its largest rate since May 2022—fuelled by an increase in international travel and higher flight capacities to Asia around the Lunar New Year.

The goods-producing industries remained largely unchanged overall, despite growth in the mining, quarrying, and oil and gas extraction sector, which increased by 2.5 per cent.

This growth was led by a 3.3 per cent expansion in oil and gas extraction, partially offsetting a contraction from January when extreme cold impacted production.

Additionally, mining and quarrying (except oil and gas) rose by 1.9 per cent, with metal ore mining and gold and silver ore mining experiencing increases.

However, some sectors did face challenges. The utilities sector contracted by 2.6 per cent in February, influenced by a drop in demand for heating following an extreme cold snap in January and ongoing low reservoir levels impacting hydroelectric power generation.

Manufacturing also declined by 0.4 per cent, largely due to a decrease in transportation equipment manufacturing and chemical products manufacturing.

In the financial realm, the finance and insurance sector continued its positive trend, increasing by 0.3 per cent in February, marking its third consecutive month of growth.

This sector was boosted by a 1.4 per cent increase in financial investment services, funds, and other financial vehicles, driven by heightened mutual fund and equity activity ahead of anticipated interest rate announcements.

Despite these gains, the public sector showed slower growth, increasing by only 0.2 per cent in February.

Within this sector, educational services edged up by 0.1 per cent, influenced by ongoing rotating strikes by the Saskatchewan Teachers' Federation, which dampened growth in the elementary and secondary schools industry.

Looking ahead to March, preliminary figures suggest that real GDP remained essentially unchanged. This estimate will be updated with the release of official GDP by industry data on May 31.

Economists have interpreted these data as indicative of a sluggish growth pattern, compounded by high interest rates affecting consumer and business spending, as reported by BNN Bloomberg.

Claire Fan, an economist at RBC, noted, “Today’s GDP report confirmed our expectations that the January surge in output was temporary, and in no way marked an inflection point for the growth backdrop in Canada that remains very weak.”

This sentiment is echoed by Benjamin Reitzes from BMO, who emphasized the loss of momentum and the additional pressure on the Bank of Canada to possibly begin cutting rates as soon as June.