Conflict premium on the yellow metal is a product of multiple global flashpoints and an uncertain world, says bullion expert

The price of gold has gapped significantly higher since the onset of war between Israel and Hamas in early October, gaining almost $100 per ounce over a few weeks. Experienced institutional investors won’t, necessarily, be surprised by that move. Gold is a historically significant safe haven asset, one investors flock to during periods of uncertainty and geopolitical tension. One gold expert, however, notes that this short-term run in gold is part of a much wider positive trend for the yellow metal.

Yvonne Blaszczyk, President and CEO of BMG Group, sees a world gripped by conflict, tension, flashpoints, and geopolitical uncertainty. In that cloudy picture, she believes gold can perform well as a growing number of investors — in the developed and developing worlds — look towards gold as a source of safety and security against heightened tension.

“This is a typical reaction in gold to any kind of significant geopolitical crisis. Any kind of crisis, whether it is economic or geopolitical, has many factors that influence market responses and movement in gold. Those responses fluctuate from day to day, or even hour to hour, but at the end of this period you can see what is truly happening,” Blaszczyk says. “This is not just temporary fluctuations, over a period of time you can see that there is a more permanent influence on the price…Global political risks are floating movers for gold, and there are many conflicts that have influenced gold in recent periods.”

Blaszczyk highlights a few periods of recent tension that have ratcheted up gold prices. Trade tensions between the US and China, China’s deteriorating relationship with Taiwan, nuclear tests in North Korea, and struggles to implement the Iran nuclear deal have all pushed gold prices higher.

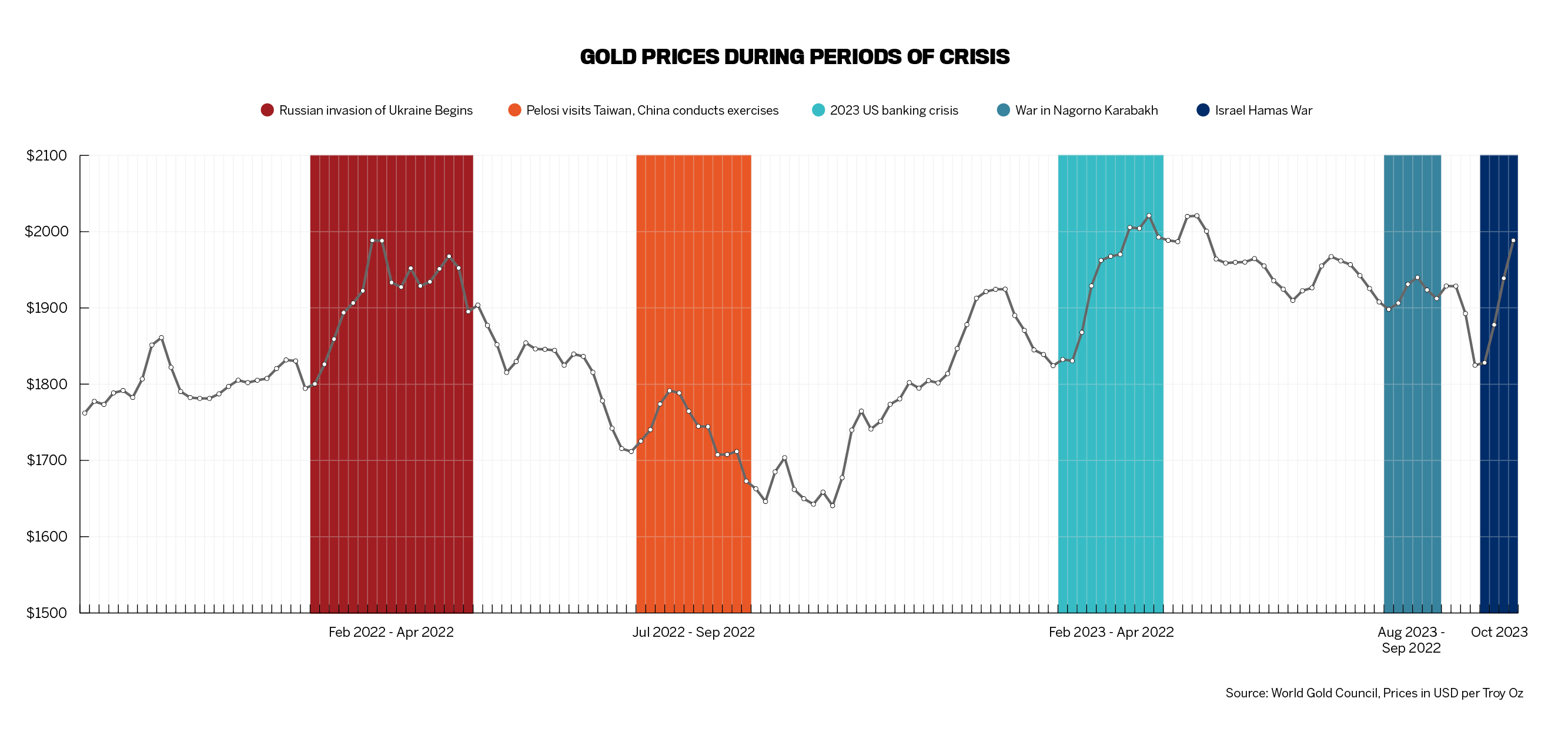

The ongoing war in Ukraine had a massive and immediate impact on gold prices. The latest round of conflict between Armenia and Azerbaijan over Nagorno Karabakh has also pushed many investors towards gold. As the below graphic shows, the past two years have seen gold price spikes closely tied to the emergence of global conflicts and economic crises.

Blaszczyk expects this era of heightened tension to continue. In part because many of these conflicts have a high likelihood of dragging on, but also because we are heading into an election cycle in the US and UK. Given the state of populism in mainstream politics, we could see monetary and fiscal policy politicized, which would in turn impact gold prices.

While gold is often treated as a safe haven asset, a rapid spike upwards in value can often be followed by a downswing. If we see a rapid resolution to this conflict, or at least stronger evidence that it won’t spin out into a wider regional confrontation, we may still see a fall in gold prices. Blaszczyk believes, however, that even if one headline conflict is resolved, the heightened state of global geopolitical tension remains, which should be positive for gold.

On a fundamental level, Blaszczyk advocates for gold as a safe store of value, with positive tailwinds during periods of uncertainty. She thinks that advisors should take a similar view to the yellow metal.

“Gold has diversification potential, and has a store of value,” Blaszczyk says, “Just like real estate and fine art, it can provide a very safe asset for portfolio diversification, that would hedge against losses in another part of the portfolio…many advisors don’t focus on gold the way they’re supposed to, but if they analyze their clients portfolios there will be evidence that this asset really ought to be included.”