Most DB plans saw positive asset returns from fixed income assets, US equities and international equities

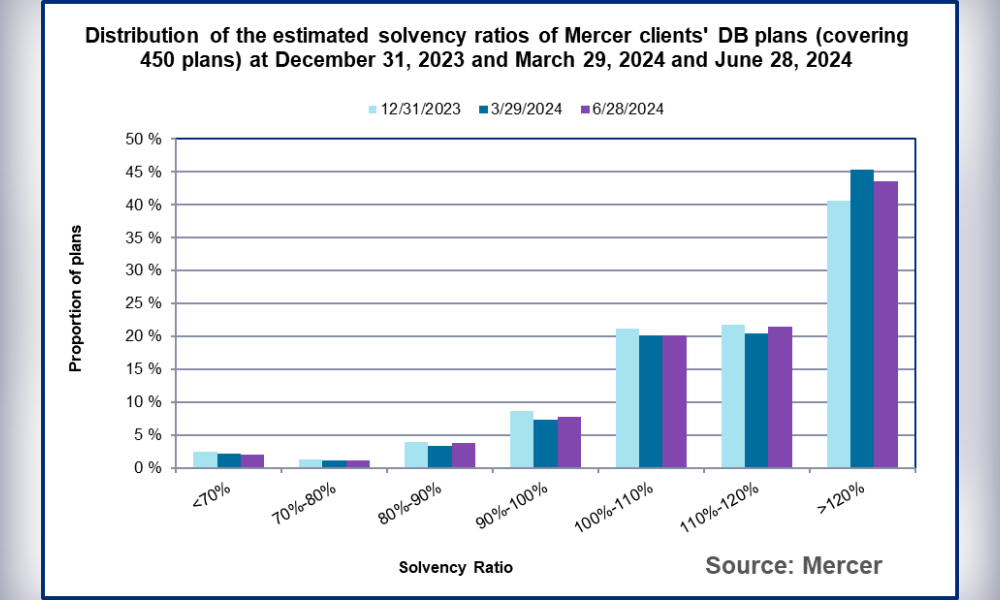

Mercer Canada released their most recent Mercer Pension Health Pulse (MPHP). Results show that despite Canadian defined benefit (DB) plans being volatile in the second quarter of 2024, the plans’ overall funded positions at the end of Q2 were similar to that at the beginning of Q2.

As most actuaries have recently said, defined benefit plans’ financial health in Canada remains strong. This is also Mercer’s message.

Jared Mickall, principal and leader of Mercer’s Wealth practice in Winnipeg, highlighted several key takeaways from their recent findings. The MPHP, a measure that tracks the median solvency ratio of the defined benefit pension plans in Mercer’s pension database was 118 per cent at the end of March, rose to 123 per cent in April, slipped to 122 per cent at the end of May and declined to 118 per cent by June’s end. The solvency ratio is one measure of the financial health of a pension plan.

“As much as there's overall maintenance quarter end to quarter end, we did see quite a lot of volatility over the quarter and that's really the overarching story. It’s a reminder that as much as you may see some improvement, it can quickly disappear,” Mickall said. “The funding position can change quickly, and it did, as we saw.”

For plan sponsors and for those who are trying to manage their plans and be good fiduciaries, Mickall says, they should understand the risk management perspective that comes with volatility and consider ways to perhaps reduce it.

Throughout the second quarter, Mickall remarked most plans saw positive asset returns from fixed income assets, US equities and international equities, which, for the most part, offset by negative asset returns from Canadian equities and increased DB liabilities. These trends resulted in an overall maintenance of solvency ratios. DB pension plans that used fixed income leverage may have experienced stable or improved solvency ratios over the quarter.

Mickall believes some of this volatility can be traced back to the Bank of Canada reducing the overnight interest rate to 4.75 per cent from 5 per cent. But despite a lot of monetary decisions made around interest rates and inflation, Mickall says defined benefit sponsors are more interested in yield curves than interest rates and the various durations of time horizons that are much longer than the overnight lending rate.

“They want to understand the overnight lending rate to the extent that might influence the rest of the interest rates along the yield curve,” he noted. “That’s one item that that will still continue to be a story that we'll be monitoring as the Bank of Canada continues with monetary policy.”

Mickall is also quick to point to the Canadian Institute of Actuaries’ recent report that found life expectancy in Canada is generally expected to improve at rates greater than those currently used predominantly by the pension industry. While this is good news for Canadians, Mickall says it signals challenges ahead for DB pensions as lifetime pensions may need to be paid for longer, which could mean higher DB liabilities by 2 per cent to 4 per cent. He advises DB pension plans should understand how the results of the new mortality improvement research may apply to their plan.

“Even if the plan is healthy, it’s another reason to re-examine your risk management process of your plans. No one wants to be trying to look at risk management when your plan is in a big deficit,” Mickall asserts. “You'd rather do it when you're calmer and when you've got some financial stability to help you out. Then you can strategically and thoughtfully plan for these risks and understand how to manage them. It's much easier to manage them when you're in a healthy funded status.”

Where do DC plans’ financial health sit in all of this? While Mickall admits Mercer doesn’t have a Pension Pulse for defined contribution plans because they’re always funded, he says DC members likely saw some growth within their asset values over the quarter. Predominantly because fixed income assets generally had positive returns due to exposure to US equities and international equities.

“They may have had some negative offsetting impacts from Canadian equities. Those that had significant weightings in Canadian equities might have been seen in a different story than those that took a diversified approach,” he noted.

Mickall added DC plan members and sponsors should check their accounts regularly and use the tools that are available to them through their providers.

“Where they do have choice, they should understand the choices they make. Always be mindful of the portfolios and mindful of understanding the individual risks. How much risk am I willing to take on that's going to let me sleep at night? That’s probably a good measure,” he said.

Finally, Mickall also advised DC members and sponsors try to understand the results of the research on mortality among Canadians as it brings into focus the risks that a member may outlive their DC account as they manage their financial plans.

“Maybe this can be a part of their communication strategy to try and educate their members about how their plans work and how these balances are supposed to work. They might think about budgeting and balancing it to go a little further in their lifetime to provide them with an income.”