Discover how a new retirement framework aims to center retirees' financial needs and enhance decision-making

In the opening part of an eight-part series, ‘(Re) Introducing the Retirement Income System: A New Framework Tailored to the Retiree’s Perspective,’ Bonnie-Jeanne MacDonald and co-authors Doug Chandler and Alyssa Hodder of the National Institute on Ageing (NIA) call for a major revision in the way Canada presents its retirement income system to the public.

“The most important question workers planning for retirement want to know is how will this system pay for my lifestyle for the rest of my life?” states MacDonald, director of Financial Security Research for the NIA.

She emphasizes the necessity of improved support for retirees, noting that current inadequacies lead to poor decision-making about when to initiate CPP/QPP benefits.

“Without better support, research shows retirees will not make the decisions that protect them long after they retire — including when to start CPP/QPP benefits. With baby boomers retiring in droves, our system urgently needs to help them when making these once-in-a-lifetime, high stakes decisions.”

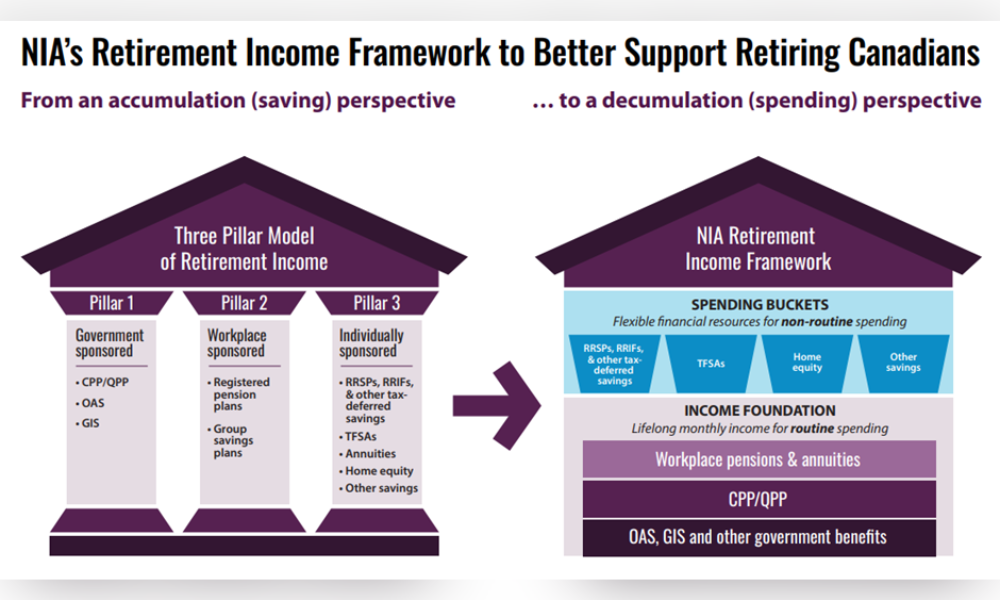

MacDonald criticizes the conventional “three pillar” model, which consists of government-sponsored programs such as Old Age Security (OAS), the Guaranteed Income Supplement (GIS), and the Canada Pension Plan/Quebec Pension Plan (CPP/QPP), in addition to workplace pension plans and personal savings.

She argues that this model overlooks the opportunity to ease workers into a retirement mindset and facilitate sound financial choices for their future.

“The irony is, the traditional ‘three pillar’ visualization comes from the perspective of providers — such as government, employers, and the financial services industry — not those it is intended to inform,” Chandler explains.

“It’s about where the money came from, not where it’s going. The traditional three pillar visual is used around the world, and yet nobody has pointed out this disconnect before. That’s a problem.”

The authors propose a transformative shift to a new framework — the NIA Retirement Income Framework — that places retirees at the forefront and reframes the retirement income system from their financial perspective.

“The ‘a-ha’ moment was realizing that lifelong monthly pension income is not a pillar of our retirement income system from the perspective of older Canadians — for them, it is the foundation and their other economic resources rest on it,” says MacDonald.

This new framework aims to better prepare Canadians for managing their finances post-retirement, aligning with their spending needs and preferences.

It suggests that routine expenses like food and utilities should be financed through lifelong monthly income from CPP/QPP, OAS, GIS, workplace pension plans, and annuities, while investments should be used for irregular expenses.

“Financial advisors, employers, federal and provincial governments, professional organizations, financial institutions, and other agencies can all benefit from supporting a more productive framing of our retirement income system,” Hodder comments.

“When it comes to communicating complex financial topics, a good picture isn’t just worth a thousand words; it can mean thousands of badly needed dollars for a vulnerable older adult.”

“This distinct, innovative solution will better serve Canada’s ageing population and the systems that support it,” asserts Alyssa Brierley, executive director for the NIA. “We look forward to working with stakeholders to help move this research into reality.”