DB pension plans weakened in Q4, but showed an overall improvement over 2023 – what does this mean for plan sponsors?

Solvency ratios for defined benefit (DB) pension plans declined in the fourth quarter of 2024 compared to the third quarter, but does this mean that plan members need to be concerned about the financial health of their pension plan?

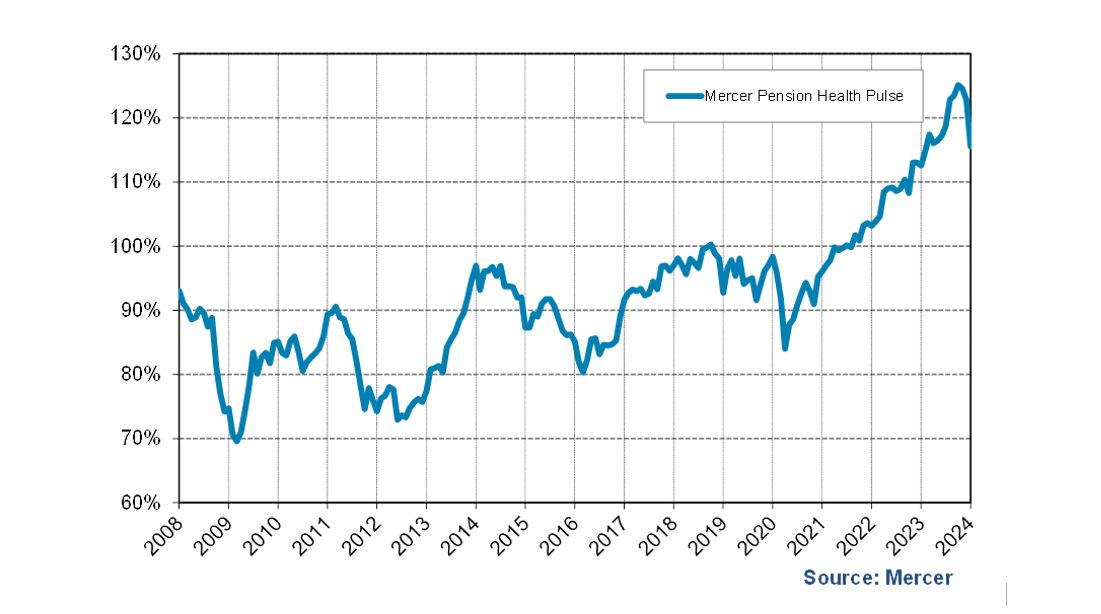

DB pension plans in Mercer’s pension database saw positive asset returns throughout the fourth quarter of 2023, but these returns were not enough to offset plans’ increased DB liabilities which resulted in an overall weakening of solvency ratios. The Mercer Pension Health Pulse (MPHP), a measure that tracks the median solvency ratio of the defined benefit (DB) pension plans in Mercer’s pension database, was 116 percent as at December 31, 2023, which is a decline over the quarter from 125 percent as at September 30, 2023, but an improvement from 113 percent at the beginning of the year. The solvency ratio is one measure of the financial health of a pension plan.

“The solvency ratio compares the plan's assets to its defined benefit liabilities. If the solvency ratio is 100 percent or more, then that means that there are assets that are more than the liabilities, which plan members would likely to think as being good or at least financially healthy,” says Jared Mickall, principal and leader of Mercer’s Wealth Practice in Winnipeg, MB. “If assets are less than liabilities, then the ratio would be less than 100 percent, which might be an indicator that the assets aren't as much as the DB liabilities and maybe the plan is not as financially healthy.”

Strong equity performance amidst volatile interest rate environment

However, Mickall says it is likely that members of DB pension plans should see improvement in the financial health of their plans because 2023 saw strong equity performance amidst a volatile interest rate environment.

“There are more plans within our database with these median solvency issues that are above 100 percent at the end of the year than compared to the beginning of the year,” says Mickall. “So, it's likely that members of defined benefit plans would have seen an improvement in the financial health of their plan over the year as a full calendar year, even though over the fourth quarter it may have declined.”

He adds that DB pension plan members expect their plan to provide the promised benefits for life. If the plan is financially healthy, that will allow members to have a degree of assurance that the promise can be fulfilled.

These fulfillment expectations vary for different demographics within the plan. A person who is retired expects their payment to be in their bank account next month while a person who just started working expects the plan to provide benefits in the future, which could be 10 years or 40 years away.

“At the end of the day, all members want assurance that when it's their time, the promised benefits will be paid.”

Members may be impacted

It is important for plan sponsors to report the financial health of their DB plans in the short term because they may need to make adjustments to safeguard the long term health of the plan, adds Mickall. These adjustments may impact plan members as well. If actions are required, the sponsor might put more money into the plan, for example. “This might mean there will be less resources for other items. If the money has to come from the plan members, it might mean active members have to pay more for the benefits they will get in the future. This could place a strain on what they see as their take-home pay.

Mickall suggests plan sponsors communicate with their DB pension plan members, make them aware of relevant facts, and let them know what actions they've taken to date and what actions they may have to take to remedy a short term unfavourable funding situation.

“The journey for a DB pension plan is very long, and successful pension plan financial management requires navigation of short-term headwinds in order to meet long-term objectives.”