Portfolio manager at TDAM weighs in on the several tools plan sponsors have at their disposal to help plan members have a healthy retirement

For plan members, retirement can be the most rewarding time of their life. However, in order to get there, Canadians have to accumulate and save their income streams. Consequently, one of the most challenging aspects of the retirement phase is the exact opposite: decumulation.

At its core, decumulation is the conversion of accumulated savings into regular income streams once someone reaches retirement or stops earning a pay cheque. In today’s market, decumulation is almost a double-edged sword. It involves balancing two opposing risks: running out of money too soon or being overly conservative, essentially underspending and not enjoying the fruits of one's savings.

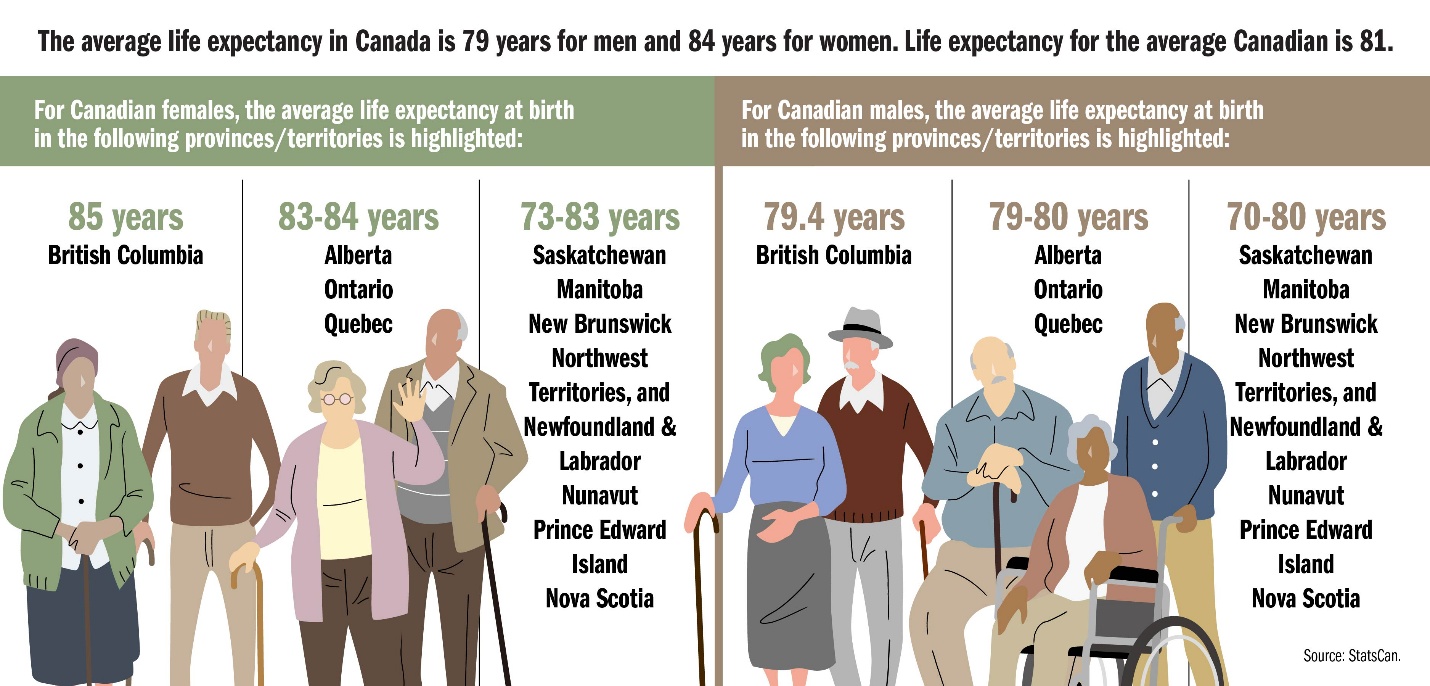

Today's retirement landscape also consists of new challenges compared to past decades. Canadians are living longer, with an average life expectancy of 81 years old. Future retirees must also contend with lower expected returns, persistently low interest rates, the decline of defined-benefit pensions, potential changes to government pension eligibility, and increased market volatility.

Read more: 10 best pension plans in Canada

Consequently, rising housing and healthcare costs, and behavioural biases, these factors make managing retirement savings more complex. Nicole Lomax is a vice president and portfolio manager for Institutional Asset Allocation at TD Asset Management. Despite decumulation becoming a growing concern for plan members and plan sponsors, she highlights several advanced strategies to secure stable and sustainable income throughout retirement.

There are several key priorities – or buckets - plan members face in decumulation; member income (the amount needed annually), income growth (preserving purchasing power amidst inflation), income stability (tolerance for year-over-year income fluctuations), longevity risk (the risk of outliving one’s savings), and capital flexibility (the ability to adjust investments or strategies mid-retirement). However, as Lomax says, improving one priority often comes at the expense of another.

“Unfortunately, when it comes to decumulation priorities, there are often trade-offs,” she says. “For example, if we want to increase member income, we often have to decrease our income stability or give up some of our longevity protection in order to do so.”

When it comes to solving “the decumulation dilemma,” Lomax says it’s about answering whether plan sponsors can concurrently improve all of these priorities. One potential solution, she believes, lies in mitigating sequence of return risk, which is, the timing of withdrawals that can permanently impact portfolio value, even if overall returns are identical.

Lomax illustrated this with two hypothetical portfolios that had the same return stream over ten years and swapping the returns experience in years nine and 10 with the returns in years one and two for Scenario B. “Imagine a plan member who has an account value of a million dollars, and they're withdrawing 8 per cent of this balance per year. Even though they have the same returns, how much could the order impact their account balance? Well, when you are drawing down capital, your timing is everything,” Lomax says.

Over the 10-year period, the illustration found nearly 20 per cent less capital “simply because the order in which returns occur.” To mitigate this, Lomax emphasizes the importance of risk-adjusted returns.

“In retirement, when we really care about minimizing sequence of return risk, we don't want to lock in those losses, we should really prioritize having a higher Sharpe ratio portfolio,” she says. “One of the most common tools that is used to help increase the Sharpe ratio of a portfolio is to incorporate private alternatives.”

She’s quick to point out the stark difference defined benefit plans have, with an average allocation of 31 per cent to private alternatives, whereas defined contribution plans have only a 0.1 per cent average allocation. Private alternatives, investments like real estate or infrastructure projects, offer differentiated income sources and diversification benefits that can improve a portfolio's risk-adjusted returns, or Sharpe ratio. “When incorporated into a portfolio, they can really reduce the volatility of that total portfolio and make it more resilient to increase that Sharpe ratio,” says Lomax.

Beyond private alternatives, Lomax highlighted other recent developments in the decumulation toolkit, including new fixed income solutions and variable payment life annuities (VPLAs). She explains with VPLAs, plan members can choose to invest a lump sum contribution into the fund. The VPLA then pools those assets together into an investment solution, and in exchange, plan members receive “a dynamic payout.”

“This payout is dynamic because it will change on a periodic basis based on the investment returns achieved by the pool and also based on the mortality of the plan members,” highlighted Lomax. She compares this to a dynamic withdrawal strategy, where with both the payout can change and is therefore low on income stability, but with positive returns. Along with potential for income growth, and “relative to an individual fixed annuity, there is potential for higher income,” she says.

“Essentially, in a VPLA, you are gaining full longevity protection in exchange for capital flexibility, because you are making that lump sum contribution,” Lomax added. For VPLAs to be truly successful, Lomax says to remove the “variable” part of the VPLA, notably, downside variability. “If we can mitigate and reduce that sequence of return risk and invest in higher Sharpe ratio portfolios, that will improve the income stability, the income growth and member income that we think are required to really make VPLAs and dynamic withdrawal strategies a success.”

She cautions that a one-size-fits-all solution is unlikely to meet the diverse needs of all plan members. Instead, she encourages plan sponsors to engage with their committees to design a "healthy ecosystem" of decumulation tools, one that potentially includes VPLAs and high Sharpe ratio funds that support withdrawal strategies.